UK litigation continues to grow whilst the economy stumbles

As the UK economy heads towards recession, claims issued in the UK High Court show no signs of slowing down

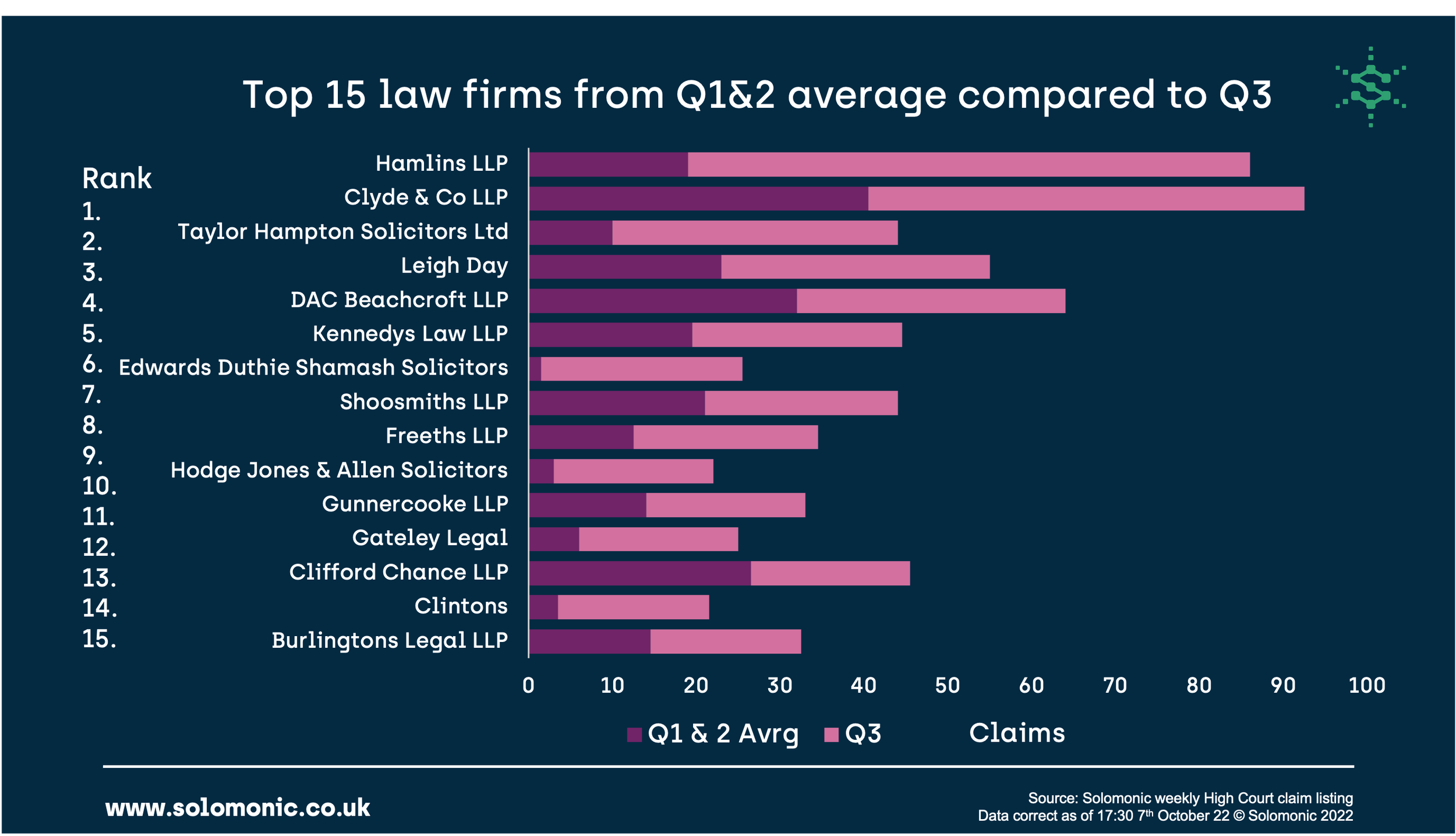

Claim volume for Q3 2022 totalled just over 1,900, a 10% increase on the same period in 2021. As a whole, quarterly claim volume has grown substantially since the first quarter of 2019. After a slight decline in new claims in the second half of 2021 and at the start of 2022, we saw a significant increase during the third quarter of 2022. In the last quarter, the 15 most active firms accounted for 13.7% of all claims compared to 14.3% and 14% in 2020 and 2021, respectively.

The quarter witnessed more litigation surrounding the infamous phone hacking scandal than we have seen for some time, with a high volume of claims being filed by celebrities, politicians, and other individuals against News Group Newspapers. In the majority of cases Clifford Chance defended News Group. Hamlins, Taylor Hamptons, and Edwards Duthie Shamash, a new entrant to the top 15, are acting for the claimants.

Top 15 law firms

Hamlins displayed a large increase in litigation activity as the surge in claims against News Group made them the busiest law firm in Q3.

Litigation giant, Clyde and Co remain one of the busiest firms YTD with an increase in litigation for Q3 compared to the average for the previous quarters. Their range of claims is wide, acting for clients on both the claimant and defendant side in shipping, technology, media and telecoms and insurance among others.

Taylor Hampton was the third busiest for the quarter and, similarly to Hamlins, experienced a substantial increase in litigation activity over the previous two quarters. They acted for victims of News Group data breaches in all but one of their claims. Similarly, Edwards Duthie Shamash, who saw a huge increase in litigation compared to previous quarters, acted against News Group in all but two of their claims.

In terms of litigation volume, DAC Beachcroft and Leigh Day remain heavyweights in fourth and fifth position. Leigh Day continues to represent the claimants in the on-going group action diesel emission disputes.

New entrant Hodge Jones & Allen are representing the defendants in a series of part 7 fire and explosion claims (10 claims in total).

Although the 15 busiest law firms and their rankings fluctuate from quarter to quarter, the overall percentage of claims that these law firms act on has stayed relatively constant over the past few years. This figure peaked at 18.4% in Q2 2021, largely due to the 112 data protection claims filed by Pure Legal. The lowest percentage of all claims was in Q2 of this year, where the top 15 were involved in only 12% of all High Court litigation. However, that percentage moved closer to the mean in the third quarter of 2022: a reflection of increased claims against News Group in September.

Litigation activity in the Magic Circle law firms has been relatively consistent since 2019. There was a small decrease in 2021, followed by a recovery in 2022, except for Freshfields Bruckhaus Deringer, whose claim volumes continued to decline into 2022. Clifford Chance figures have been boosted by defending News Group but when those disputes are removed their pattern mimics those of the other magic circle firms. In 2021 and 2022, Linklaters and Slaughter and May both had equal claim volumes.

Top sectors

Comparing sectors for the same period this year and last, there has been a strong correlation in claim volume. Claims in construction and infrastructure as well as in banking and finance have marginally increased. On the other hand, consumer products, the public sector and manufacturing and industrials have experienced a small decline in claim volume. The outlier is Technology, media, and telecoms which experienced a huge increase in claim activity, making it the busiest sector in 2022 to date, boosted in large part by the claims against News Group.

This quarter has seen German biotechnology and pharmaceutical giants BioNTech and Pfizer, creators of the COVID-19 vaccine, sue US pharma Moderna regarding Moderna’s Corona vaccine patents. Freshfields Bruckhaus Deringer is defending Moderna, while Taylor Wessing and Powell Gilbert are defending Pfizer and BioNTech.

Winding Up Petitions

Winding up petitions are utilised as a last resort to enforce debts including debts arising from court and tribunal judgments. This is happening on an increasingly aggressive scale after the effects of COVID-19. The HMRC has also been eliminating so-called 'Zombie' companies which accumulate unsettled UK tax debt obligations. This has resulted in a significant increase in winding up petitions, as shown in the chart above.

*NB: Our analysis includes all publicly available King’s Bench and Chancery Division claims but currently excludes Insolvency & Companies list and Personal Injury and Clinical Negligence cases except the ‘Winding up petitions’ chart which includes Insolvency & Companies list data.