Litigation’s long shadow: War, crises, scandals and cash (2023 and beyond)

Solomonic assembled a powerhouse panel of industry experts to delve into the insights from the 2023 Year in Review report and discuss the trajectory of English High Court litigation in the coming years.

2023 was characterised by significant geopolitical, pandemic and economic events that loomed large over the High Court: the Russo-Ukrainian conflict, the dieselgate scandal, pandemic fallout and global economic instability. Amidst Middle Eastern tensions and political uncertainties, Red Sea attacks at the end of the year only added to the boiling pot. This disruption has ultimately made for a busy time for litigators.

Disputes can run for many years after a crisis or event, the collapse of Lehman Brothers in 2008 continues to permeate claims even into 2023. Given this dynamic, our data highlights a ‘long shadow’ evident in litigation with past and current events continuing to have a significant impact on the disputes landscape.

A surge in insurance claims and the busiest year for the banking and financial sector marked 2023, alongside the emergence of some interesting cases including the first real test of AI copyright infringement under UK law. Despite the (now reversed) PACCAR decision, confidence that more group action and funded claims remains very high.

On 22nd March 2024, Solomonic assembled a powerhouse panel of industry experts to not only reflect on the aftermath of 2023 and Year in Review report findings but also gaze into the future and discuss how they see things playing out in English High Court litigation over the coming years. The panel comprised:

Maura McIntosh, Professional Support Consultant at Herbert Smith Freehills, with a particular interest in class actions

Tom Dane, Partner at CMS, and head of finance disputes

Hugo Marshall, Investment Manager (EMEA), Litigation Capital Management, with a focus on funding litigation

Gareth Hunt, Global Head of Legal Services at Stifel-KBW, who advises law firms and litigation finance businesses in the US and UK

Challenges and resilience of group and collective actions

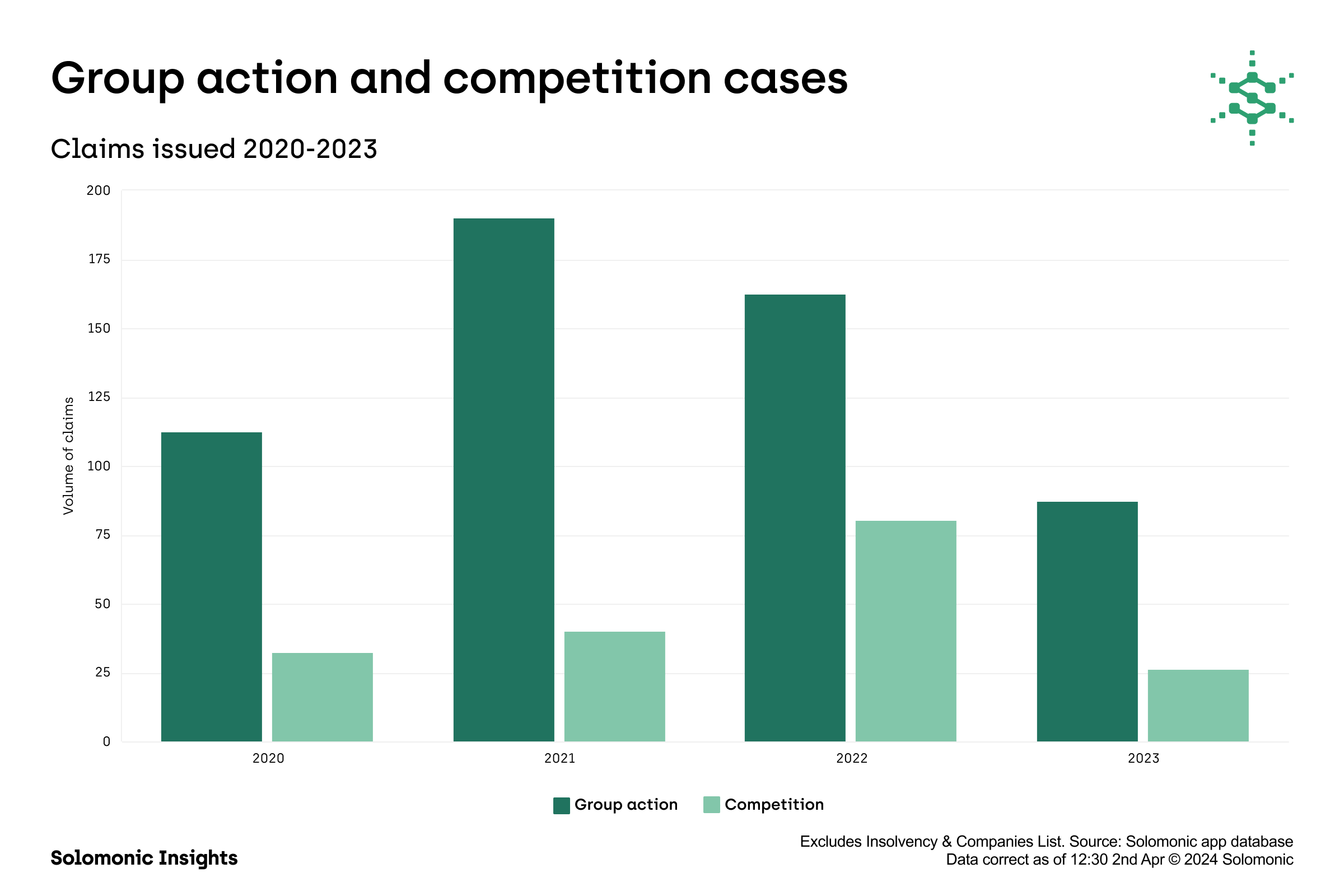

The session opened with a deep dive into the group litigation landscape, as Solomonic recorded a decline in new group action claims in 2023 compared to previous years. Despite this, McIntosh, one of the general editors and co-authors of Class Actions in England and Wales, emphasised that class and groups actions are here to stay, and unlike a decade ago, have become firmly entrenched in the litigation landscape. Easier claimant recruitment via social media, funder appetite and the general normalisation of these actions demonstrate their longevity.

McIntosh noted, “Even if there has been a bit of a downward blip in claims issued, group actions have become more prominent, so many of the judgments we see, including on interim decisions, are part of group actions. Group actions are becoming more normal, more routine, and they are getting larger. When we wrote the 1st edition of Class Actions in England and Wales back in 2018, the largest group actions were in the tens of thousands. Now we have the emissions litigation with I think more than a million claimants across 13 different GLOs (group litigation orders) and it is so massive that the court is managing 4 lead GLOs to stop the courts being overwhelmed in the coming years. In terms of prominence and size, class actions are becoming ever more important.”

The Competition Appeal Tribunal (CAT) continues to grow in importance and is favoured where a competition angle can be framed as it gives the advantage of opt-out. The potential success of such opt-out cases in 2024, such as the BT case, could further establish the CAT as an attractive forum for litigation and play a role in the future volumes of claims. At the same time, the High Court continues to play a vital role for shareholder, ESG, product liability and data privacy claims being issued here.

PACCAR U-turn and funding impact

Despite the initial disruption caused by the PACCAR decision, swift legislative action will mitigate its impact on funding appetite. The decision, while significant, did not substantially deter funders but instead highlighted a need for greater competitive pricing.

Marshall explained, “This isn’t the first time the industry has faced a setback, rewind to 2020 the Chapelgate decision came out and there was a bit of handwringing about that and whether it would be the end of the Arkin cap. The factual specificity blunted the impact on the wider market, in the same way PACCAR is another hurdle that the industry has had to face and navigate in a sensible, commercial, pragmatic way.”

Financial sector claims activity

The session then turned to the banking and financial services sector which experienced its busiest year for new claims volumes since 2014 (when Solomonic records began). Historically, this sector competes with professional services as the most active but has led in recent years. This high is significant considering the volume of financial issues such as PPI and motor finance handled outside of the High Court by the Financial Ombudsman Service, as well as the county courts. Consumers and businesses rely heavily on financial services leading to numerous touchpoints for potential disputes.

Dane outlined areas of claims driving activity in 2023. Litigants in persons are a common feature in claims against retail banks. Various claims relate to Norwich Pharmacal/Bankers Trust disclosure orders, so not technically claims against banks, but rather, seeking information to trace fraudulent payments which are increasing. There are numerous claims under guarantees, including personal guarantees, where the principal obligor has defaulted which reflects the economic times and people taking action in this respect. ‘Follow on’ claims based on regulatory findings are also typical in this highly regulated sector, leveraging finding by regulators in the UK or US.

One area experienced a rise, potentially influenced by last year’s high profile ‘debanking’ dispute involving Nigel Farage, where multiple claims relate to situations where banks have frozen a customer’s account and/or purported to end the banking relationship. Though Dane noted a recent High Court decision in January regarding Revolut might put a dampener on some of these claims going forward.

Additionally, Dane pointed out an interesting trend as of late whereby claimant law firms have been rushing to bring claims early following significant market events. For example, after Credit Suisse’s regulator wrote down the value of its AT1 bonds to zero, paving the way for the UBS takeover, two claimant law firms brought actions in Switzerland within a month as a prelude to actions in other jurisdictions. This trend reflects the evolving environment where litigation also promptly follows significant market events and claimant law firms want to stake their claim to being the lead firms acting on mandates, although the long shadow of claims such as PPI will still persist. Ongoing risks in 2024 include motor finance commission claims, with the FCA currently investigating, and new rules being introduced to address the circumstances in which a bank can end a customer relationship. In the financial services sector, the susceptibility to class actions remains high, with banks involved in some of the leading decisions across various areas including securities litigation and forex manipulation. Banks are also highly exposed to consumer-led actions.

On the GC radar: Class actions, ESG, cybersecurity risks and sanctions

The panellists highlighted what might be sitting at the top of the risk monitor for GCs within organisations considering the speed at which disputes can arise following significant events, as well as the opposite scenario where issues may take a considerable amount of time to surface or persist for many years.

Dane characterised it as a ‘shopping list’ of potential risks, and the panellists collectively agreed that class action risk has risen to the top of most agendas sector wide.

Climate change and ESG too is looming large as a potential risk and warranted significant discussion. On the regulatory front, the CMA plays a role and the FCA’s upcoming anti-greenwashing rule is crucial. A rise in activist litigation, with groups like Client Earth and other NGOs initiating actions to drive behavioural change or raise awareness will likely persist. While ESG litigation for commercial return hasn’t been widespread in the UK so far, it is expected to increase, which could see mis-selling claims for “green” products or securities litigation, which may take the form of class actions. The transnational torts aspect is continuing to be significant, where corporations are sued in the UK and other major jurisdictions for the actions of their subsidiaries abroad, such as pollution or human rights violations. These cases can involve substantial claims and extend to supply chain issues, as seen in a claim against Dyson for alleged factory issues. While UK courts may not accept jurisdiction over all of these claims, following rule changes post-Brexit, their scale remains a significant concern.

The realm of cyber risks is evolving rapidly, with increasingly sophisticated AI-driven phishing attacks emerging as a significant risk hotspot.

Finally, the effects of enhanced sanctions, particularly those targeting Russia, are still unfolding and playing through into disputes. There's a growing rhetoric around utilising sanctioned funds to aid Ukraine, indicating further developments in this area.

Legal sector investor attractiveness remains alluring

The past period has seen significant activity. For instance, Mishcon de Reya considered a listing but ultimately retracted, while DWF delisted from the London Stock Exchange.

In 2023, capital market activity was incredibly subdued, yet legal services performed relatively well, albeit slightly quieter from a capital perspective. DWF's move to private ownership marked a significant transaction, while Burford emerged as one of London's top equity performers, reflecting a strong year from a shareholder standpoint.

Hunt expanded, “As markets have generally improved coming into 2024, we have definitely noticed a substantial uptick. Two trends are driving that; the first is strategic - legal services market is colossal on a global basis and although for historic ownership reasons, external investors haven't been able to get equity capital into the sector yet, there is a strong strategic desire for institutional capital to find its way in, and that appetite remains undiminished. Secondly, the nature of the assets being created in legal services are generally non-correlated to economic cycles and so it doesn’t really matter what is happening with inflation, interest rates or the level of a particular capital market like the Dow Jones. So, it is a large and very economically attractive sector.”

Case duration has become a significant concern, particularly in relation to US mass torts where some major cases have extended well beyond expected timelines. Clients are therefore increasingly focused on understanding the duration of the assets being offered, with data able to play a role in addressing this concern.

While the business of law has remained largely unchanged for centuries, the traditional law firm partner model is under scrutiny for its need to evolve, especially if equity is to enter the sector meaningfully. The path to public equity has faced challenges due to the macroeconomic environment and company specific factors. There is still public institutional interest but private markets remain very busy indeed. Some UK law firms are exploring options to raise minority equity, which could “grease the wheels for mergers and acquisitions” and provide additional incentives for partners. With capital becoming more constructive, we may see developments come to fruition in the coming months.

AI and data here and now versus their lasting legacy

Looking ahead, the intersection of forecasting, AI and data analytics poses significant challenges and opportunities for the legal sector. Solomonic data shows the consistency in volumes of contentious legal work and London continues to be a preeminent centre for dispute resolution. Further, behind the scenes, Solomonic predictive modelling shows very impressive levels of accuracy.

From Hunt's perspective he said investors are drawn to structured data and it holds significant promise in the eyes of capital markets.

“Investors love data, so historic information that can be used to assess track record systematically is very valuable; but the holy grail is to use data predicatively, that would be viewed very positively by capital markets.”

Other members of the panel opined that AI and predictive modelling can enhance efficiency and cost-effectiveness but shouldn't supplant decision-makers. Micro-level application in individual cases presents conceptual challenges. Mock expedited arbitrations involving generative AI models undertaken by CMS reveal AI's proficiency in handling basic law, yet it struggles with complex areas, prone to producing ‘hallucinations’ or making up case principles or arbitration rules. AI's inherent biases and tendency to ‘people please’ pose further challenges. The panellists ultimately agreed that AI is anticipated to enhance human decision-making, offering efficiency gains without displacing human judgment. Solomonic’s fundamental pillars of producing robust and accurate data to deliver sustainable and defensible insight only reinforces this consensus.

Access the full webinar recording below.