How do you make a rainmaker?

Solomonic CRO, Pete Nussey, draws an additional conclusion to a recent Harvard Business Review study, that data and analytics play a vital role in the making of a modern-day rainmaker and are key to achieving top performance.

The legal services market has become significantly more competitive in recent years and High Court litigation is no exception. The challenging macro-economic environment, fundamental changes in client behaviour (including procurement), a decrease in the volume of High Court claims and the aggressive American firms have put a spotlight on firms’ and partners’ business development practices. A timely study from Harvard Business Review and DCM Insights concludes these practices are most likely outdated and offers a blueprint for high performance. Our CRO, Pete Nussey draws an additional conclusion on the vital role data and analytics plays in the making of a modern-day rainmaker.

‘What Today’s Rainmakers Do Differently’ starts by confirming what many will suspect. Clients are much less loyal than they once were. A survey of C-level execs finds that 5 years ago, 76% of buyers preferred to buy again from partners or firms they had used in the past. Today, that is down to 53%—and over the next five years, it is expected to drop further to 37%.

It’s no surprise they find that buyers are no longer defaulting to established relationships and are considering a range of alternative service providers or that the good folks in procurement are now as interested in vetting legal spend as they are the higher profile spend categories (such as SaaS).

‘Tracking the market and your relationships with a platform like Solomonic will help you understand how enduring they, and your expertise, really are.’

This slowdown in repeat business would, on its own, be enough to rattle most partners. It strikes at the core of a firm's commercial model and the widely held belief that, if you do a decent job and work on the relationship, clients will stick with you. However, we see this exacerbated by two compounding factors, firstly, claim volumes are down for all but a few firms’ year on year. Secondly, this sort of negative trend where the percentage of total client instructions is decreasing, isn’t always known (pitch win rate is also rarely noted). This is likely a consequence of partners juggling fee earning and business development but it’s harder to tackle a problem you are not picking up. Tracking the market and your relationships with a platform like Solomonic will help you understand how enduring they, and your expertise, really are.

The Activator

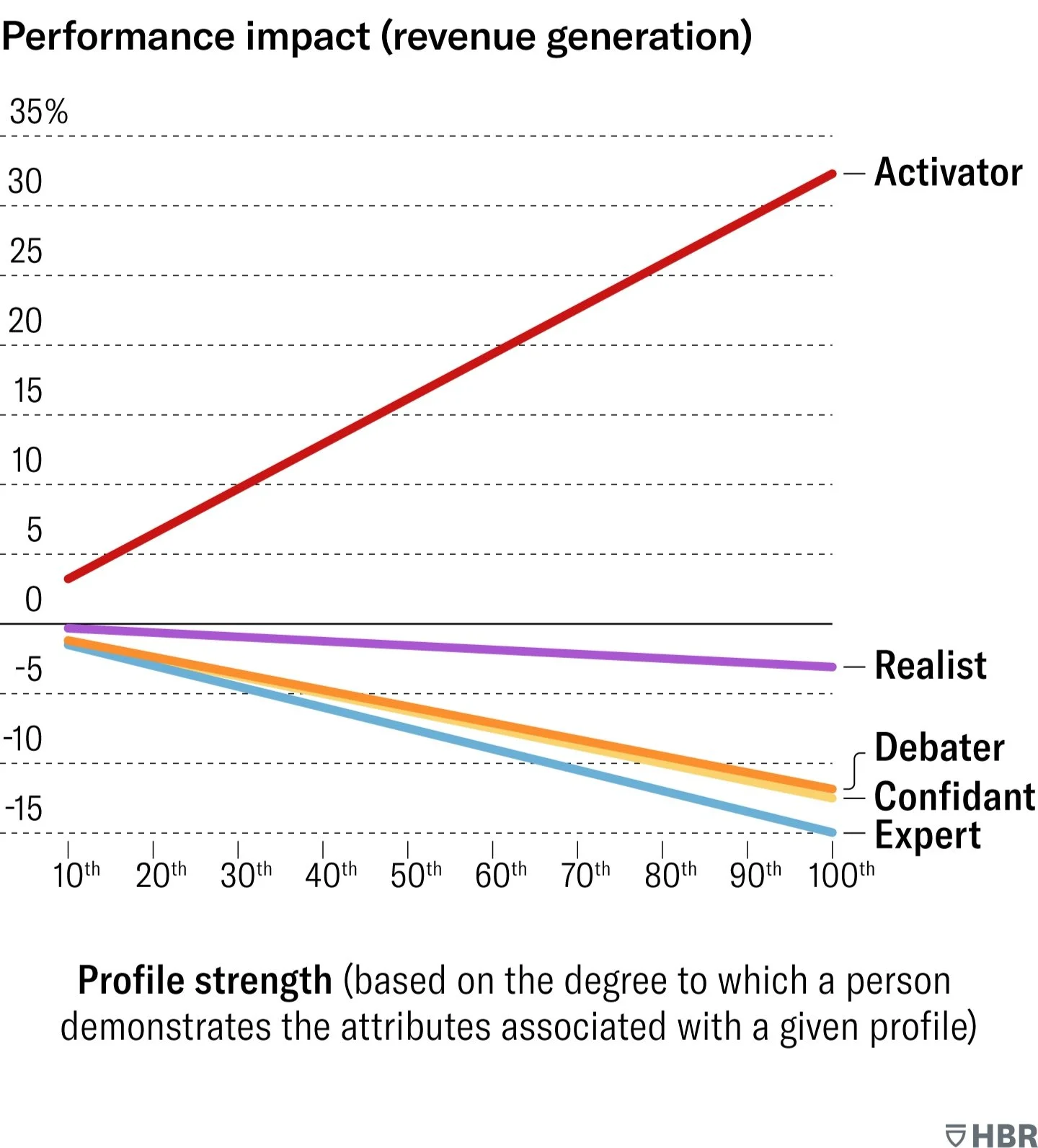

If BD performance is more important than ever what can the data gathered by the team at HBR tell us about best practice? A global study of nearly 1,800 partners from across 23 firms collected data on partners’ BD behaviours. More than 108 attributes were clustered to define 5 profiles.

Experts unsurprisingly focus on demonstrating and communicating their expertise.

Confidants invest heavily in building key relationships.

Debaters relish pushing clients outside their comfort zones.

Realists pride themselves on their transparency, and honesty about what can be achieved and at what cost.

Activators proactively build networks and “harvest” business from them.

Chart by Harvard Business Review

Only one profile —the Activator—shows a positive impact on performance and revenue.

The Activator approach includes three behaviours for success namely:

Committing to business development as a crucial part of the job

Connecting with prospects, clients, and colleagues

Searching for ways to create value

If the ‘3 Cs’ alliteration seems familiar, it is because Matthew Dixon the architect of the Challenger sales approach - a game changing methodology for B2B sales built around 3 Ts - is also behind this study via his consultancy DCM insights.

Armed with these good behaviours how does one transition across to becoming an activator and top rainmaker? The article suggests training incentives and software, including networking and collaborative platforms like LinkedIn and Slack all have a role, but I’d suggest the most important enabling factor is good market data and corresponding insight.

How Solomonic can help

The Solomonic platform provides accurate, reliable, and quality data on UK High Court litigation. It is extensive with 10 years of data, including over 110,000 claims, 8,900 judgments, 200,000 parties, 5,900 law firms and 17,000 documents. Court data is collected, meticulously analysed, and published via a combination of technology and human review. This unique insight provides partners with the material to - in activator terms - connect and create value. Below are just a few examples of how:

Consider a law firm where the DR partners are covering some of the basics - reasonably active on LinkedIn, the occasional speaking slot, webinar, client event etc - but there is a recognition they need to take a more strategic approach to BD. They ringfence time for it but need clarity on where and how this valuable time should be spent.

They could start by understanding precisely who to target and how they should approach them (i.e. connecting and creating value). One way to do this is to assemble a list of the firms existing clients for non-contentious work where a relationship already exists. Mapping this list to the Solomonic database will immediately show those most active in the High Court. This group can then be prioritised according to multiple factors starting with claim volume and/or value, to create a focused list to connect with.

Attention can then turn to the ‘creating value’ behaviour. Using the platform, a partner can build a tailored report for each target to include the following, readily available, insights:

The target’s litigation profile, meaning their record on settling or going to trial. This can be benchmarked against the sector average.

A view of the target’s competitors including case volumes, litigation profile, regular opponents etc.

A similar view of the target’s opponents activity volumes, outcomes etc.

Evidence of the firm’s expertise in areas that align with the targets claims, ‘we have worked on x similar cases in the last y years with the following outcomes’.

Likely outcomes on ongoing claims based on court and judges win: loss data.

High court trends their client should be aware of e.g., the continued flow of Covid related business interruption insurance claims.

Commentary on what the target might want to consider in future based on the experience of their competitors.

Equipped with this unique insight, partners can collaborate with colleagues to facilitate an introduction and further discussion with the target. Tracking the target’s activity in the platform completes the sequence and enables further timely connection.

Variations on this approach include:

Mapping existing contentious clients to the Solomonic platform to understand what instructions are being missed. Using the platform’s relationships data will illustrate if and where a firm’s share of instructions has declined, enabling them to take remedial action connecting and crafting value via insights (as above) and setting up an alert to track all future activity.

Where a firm is looking to expand their footprint in a sector or subject area where they have an existing, albeit limited presence, a target list can be built using Solomonic analysis to pinpoint the most active parties etc. The above approach can then be followed.

An additional C, curation. Using Solomonic’s detailed filtering tools (e.g., topic, legal subject matter, sector, documents and more) as well as trend reporting enables partners to curate information that will inform or add to their client’s risk radar. Setting up alerts (which may include when their competitors are issued against) is a valuable early warning mechanism for clients too.

Solomonic clients, who include many of the top 100 firms, frequently feedback the success of these tactics in delivering new work often running into seven figures per instruction.

Conclusion

It will be an uncomfortable reality to accept that the business is flowing not to those who demonstrate expertise (which at some level is ‘table stakes’) or to those who invest most heavily in their key relationships, but to those who make time to reach out to the right people at the right time with information that adds value. The good news is that with tools like Solomonic, top performance is achievable for all. In a competitive environment, good data can level the playing field.

Author: Peter Nussey, CRO, Solomonic