High value Russo-Ukrainian war and Covid insurance cases mark an otherwise subdued first half of 2023

High Court litigation in the first half of 2023 (H1), while down on both halves of 2022, has seen some very high value disputes, as the impact of the Russo-Ukrainian war and ongoing Covid-related business interruption claims flowed through the courts.

Some dispute areas with high volumes in 2022, phone hacking related cases for instance, have tailed off. On the other hand, claims related to diesel emissions continue to come through; cases against public sector bodies (Police and Health) have been frequent as well.

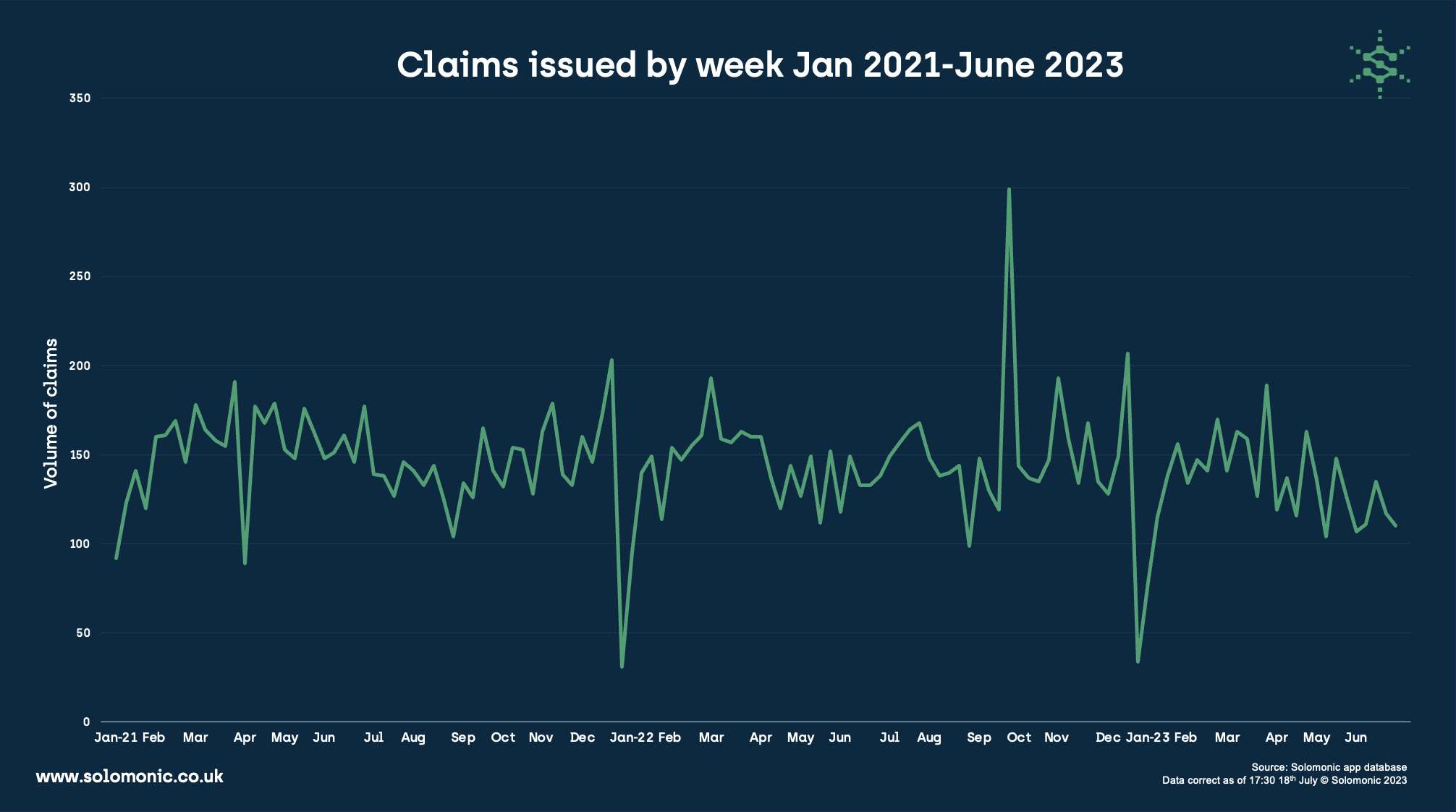

The number of claims in HI 2023 (approximately 3488) was 6% less than in the same period in 2022 (3719) and 13% less than 2021 (3993).

2023’s first half is also 10% down on the second half of 2022 (3873). The year has also been characterised by a lack of any large peak in claims issued; indeed, January saw the lowest start to a year since 2020.

Top sectors

Despite the slightly lower claim volumes, certain sectors have been very busy. Construction as well as Professional Services disputes have been close to their previous levels; most notably, the Insurance sector has seen a 63% jump in disputes compared to 2022, driven by a raft of claims generated by the Russo-Ukrainian war and steady feed of business interruption claims coming out of the Covid pandemic.

In contrast, Banking & Finance disputes were 17% down on H1 2022. Manufacturing saw an even bigger drop, 29% down on H1 2022 activity.

Top law firms

The top firms acted in over 700 claims in the first half of this year, their activity 8% down on 2022 and almost a quarter down on 2021. However, Leigh Day, Hamlins, Hill Dickinson and Stephenson Harwood stand out for having increased their activity levels.

For Hamlins, this was almost all generated from rights protection work for the Performing Right Society and Phonographic Performance Ltd.

Leigh Day have been active in issuing claims against car manufacturers, distributors and dealerships in relation to the Dieselgate scandal, as well as in claims against public sector bodies.

Litigation heavyweight, Stephenson Harwood, has acted in a range of cases including in Banking, Insurance and Shipping.

Top claimant law firms

Leigh Day, Hamlins and Clyde & Co continue to occupy the top three spots, as they did in H1 2022. Clyde’s breadth of work drove their activity levels, whilst Hamlins has been very busy enforcing recording rights for the performing rights bodies. Leigh Day continued to issue emission scandal related claims as well as claims against public sector organisations. Shoosmiths saw an active start to the year across a range of sectors, reflecting their penetration of mid-sized businesses and consumers.

Herbert Smith Freehills tend to be defendant oriented. However, 2023 has seen them acting on behalf of a significant number of aviation companies, all in dispute with their insurers relating to aircraft seizure emanating from the Russian invasion of Ukraine. Stephenson Harwood feature in the top 10 after a strong start to the year representing claimants in Shipping, Aviation, and Insurance disputes.

Top defendant law firms

Powerhouse litigation firms DAC Beachcroft and RPC featured in the top 3 for 2022, and 2023 has been no different as their work across the market is reflected in the volumes. Weightmans have had a busy start to the year, thanks in the main to their strength in the Public Sector but they have also been active in Insurance disputes.

HFW (Holman Fenwick Willan) make a welcome return to the list in sixth position, in a busy start to the year, their work in Insurance disputes giving them a boost. Clyde & Co feature for their cross-sector work, and legal giants CMS and Eversheds Sutherland have a similarly strong market presence. One notable change is the absence of Clifford Chance, largely reflecting that the phone hacking and privacy cases against News Group Newspapers have tailed off in 2023.

Top law firms by average claim value

While new claim volumes have been low, we have seen some hefty claims issued in 2023. A number of them relate to the seizure or grounding of aircraft by the Russian state in response to international sanctions related to the Russian invasion of Ukraine.

Herbert Smith Freehills has been active in a number of these claims and their average claim value reflects it. Others, including litigation heavyweights Stephenson Harwood and HFW, have seen these high stakes aviation claims on their books, with Weightmans also involved. CMS have been active in high value M&A related disputes.

All data correct as of 17:30 18th July 2023.

*NB: This analysis includes all publicly available King’s Bench and Chancery Division claims, excluding Insolvency & Companies list and Personal Injury and Clinical Negligence cases.