Commercial Court affirms position as global high-stakes forum

The Commercial Court doubles down on bet-the-company disputes – Solomonic data shows a clear increase in LCCC and Circuit Commercial disputes.

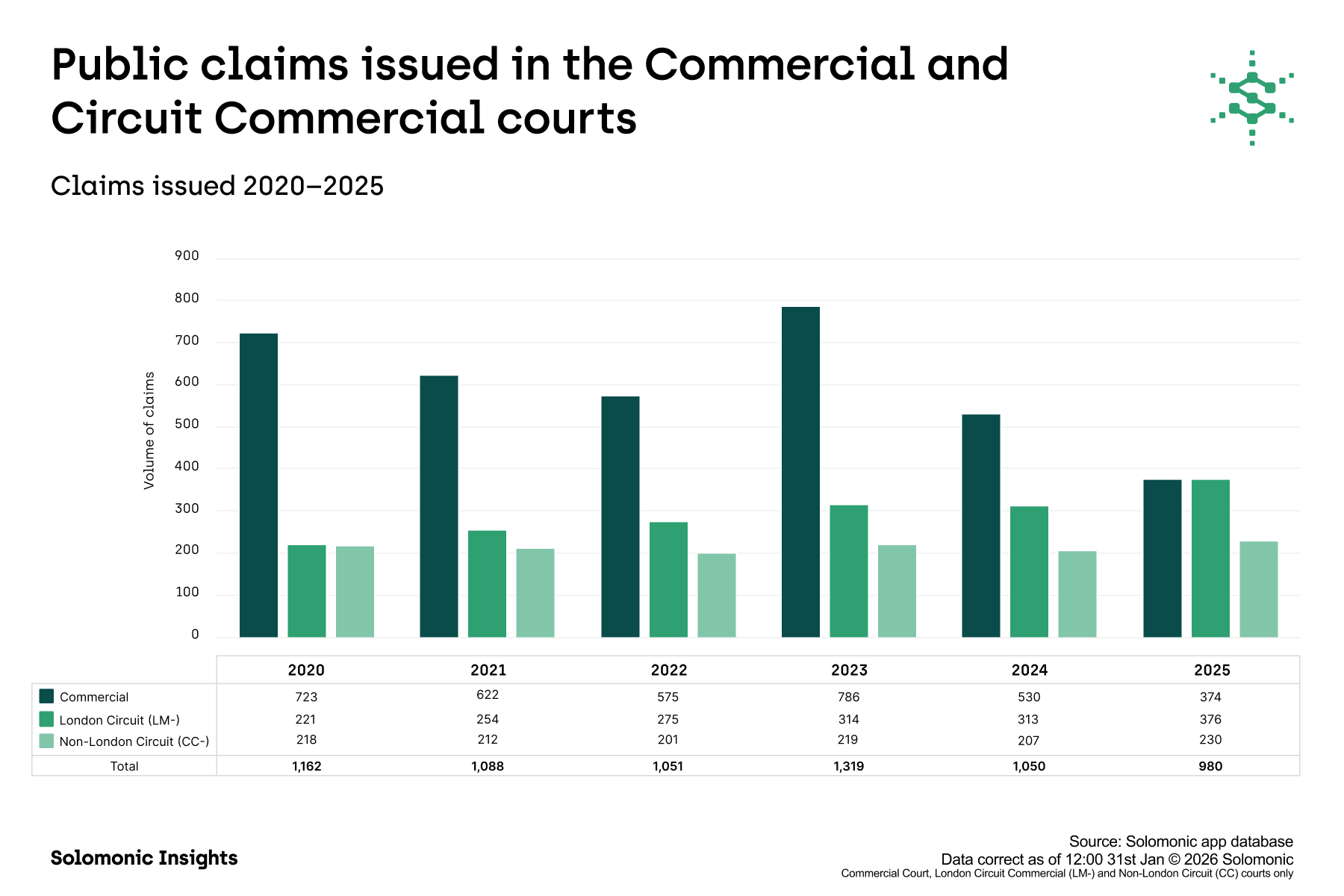

High-value, headline-grabbing trials dominated the Commercial Court’s profile throughout 2025. At the same time, our data reveals how the rebalancing of workloads across the Commercial Court and Circuit Commercial Courts, repositions it as the apex court for bet-the-company disputes. As a result, the Commercial Court and London Circuit Commercial Court (LCCC) recorded almost the same number of public claims (374 and 376 respectively). Outside London, the circuit courts also saw growth, with public claims rising by 11% between 2024 and 2025.

The trend is also consistent with structural differences between the courts. The Commercial Court continues to handle a considerably greater proportion of Arbitration Act appeals than the LCCC. This is reflected in the differing proportions of public versus private claims observed over the last couple of years where the Commercial Court marked 238 private claims in 2025, compared to the LCCC with 68.

As of July 2025, the indicative claim value threshold for transferring cases from the Commercial Court to the LCCC was raised to £7 million (excluding interest and costs). This higher threshold has enabled the Commercial Court to concentrate on a smaller cohort of more complex, high-value cases.

Correspondingly, a growing share of claims is now being issued in the Circuit Commercial Courts. Between 2020 and 2023, these courts accounted for around 40% of public claims, rising to 50% in 2024 and 62% in 2025. Over the same period, the Commercial Court’s share of total public claims fell to 38% in 2025.

Taken together, the data suggests that the expansion and promotion of the LCCC, alongside increased use of the wider Circuit Commercial Courts, has played a significant role in alleviating the post-Covid case backlog. More importantly the Commercial Court now appears firmly positioned as a specialist global forum for big-ticket, complex and higher-value disputes. Plus, with the Transparency Pilot already well underway, our attention will turn to how that plays out in the data.

What do the latest English Commercial Court trends mean for in-house teams trying to manage litigation risk in 2026?

High‑value disputes, shifting forum choices, growing international caseloads and new transparency pressures are all reshaping how cases are run and how much risk sits on your balance sheet.

Join us on 4 March 2026 for a webinar in partnership with HFW. Andrew Williams, Global Head of Commercial Litigation at HFW, Edward Bird, CEO of Solomonic, Dame Elizabeth Gloster of One Essex Court, and Richard Blann, Head of Group Litigation at Lloyds Banking Group, will unpack what this means in practice for corporates and financial institutions.